We all know saving for retirement is important, but with so many investment options out there, deciding how to invest your pension contributions can seem like a daunting task. The good news is that when you choose My Future ESG Lifestyle Strategies from Aviva as your default pension savings option, we do all the work for you. You won’t have to make investment decisions or choose funds. You simply tell us your expected retirement date and how you’d like to take your retirement income and we will gradually and automatically reduce the risk profile of your pension savings the closer you get to retirement.

Risk management

My Future ESG Lifestyle Strategies aim to grow your money when retirement’s a long way off, then reduce the risk of your savings falling in value as you get closer to your retirement date.

Personalised solution

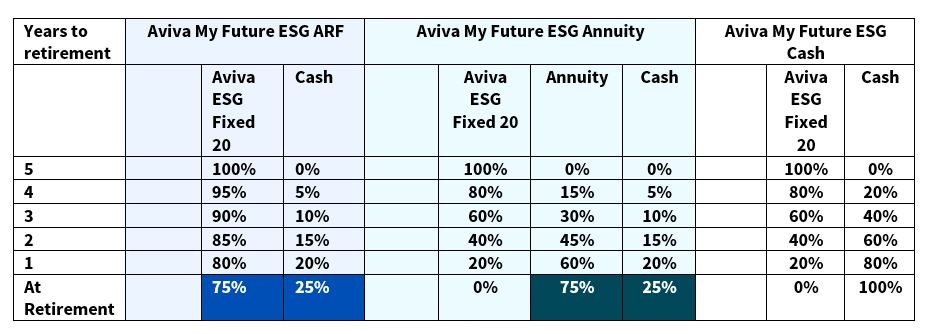

My Future ESG Lifestyle Strategies is tailored to your normal retirement age and whether you’d like to fund your retirement income through an:

- Approved Retirement Fund (ARF)

- Annuity

- Cash for those who are funding for a lump sum only

Low-cost professionally managed solution

The low-cost investment strategy offers an alternative to changing your investment funds independently as you head towards retirement. This strategy is suitable for novice and sophisticated investors alike who would like a passive approach to managing their pension.

Responsibility built-in

The fixed allocation funds, which are core components in all strategies, aim to deliver attractive returns through a strong focus on environmental, social, and governance (ESG) factors. They are all classified as Article 8 or light green funds under European Sustainability Regulations1.

You can also take your retirement income using a combination of an ARF, Annuity and Cash. Your allocation to each income option will determine how we change how your money is invested.

What is an ARF?

An Approved Retirement Fund (ARF) is a personal retirement fund where you can keep your money invested after retirement. You can withdraw from it regularly to give yourself an income. ARF payments are taxable as income. Any money left in the fund after your death can be left to your beneficiaries under your will.

What is an Annuity?

An Annuity provides a regular income for the rest of your life, no matter how long you live. You can buy an Annuity with the money from your pension fund. Annuity payments are taxable as income.

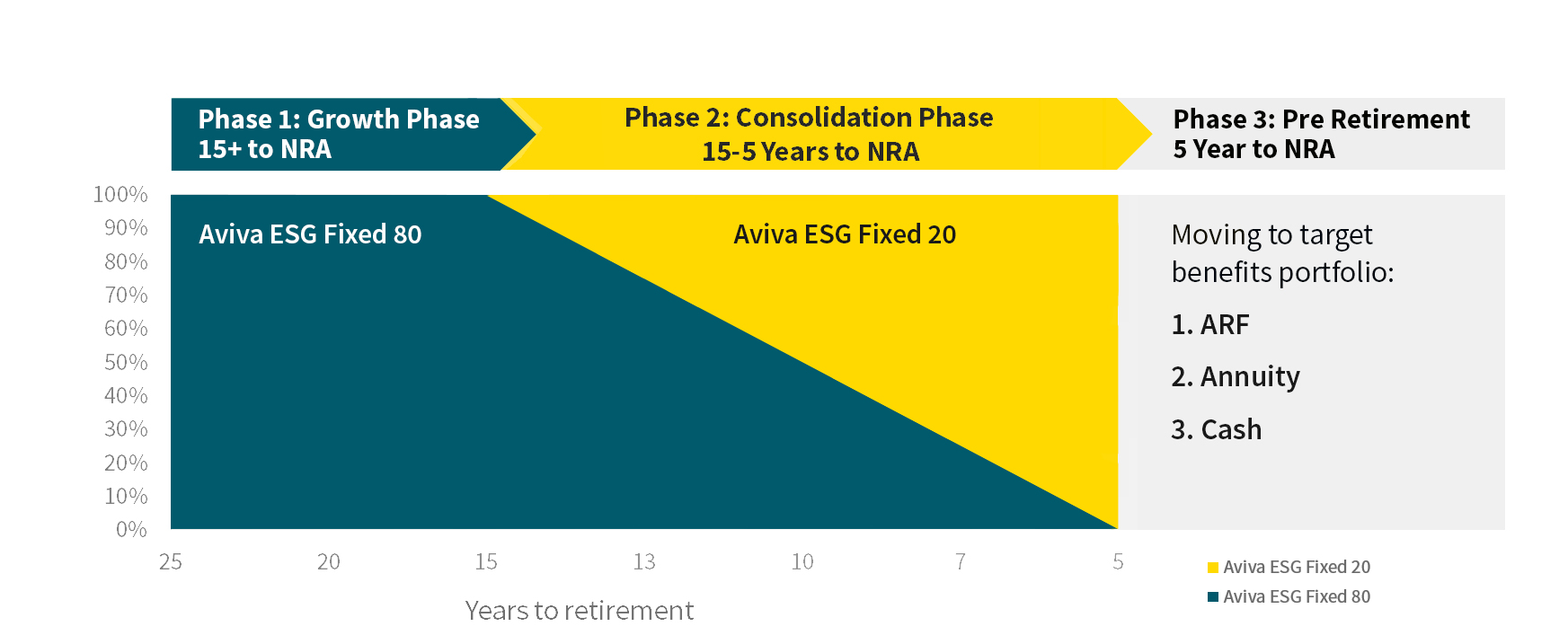

My Future ESG Lifestyle Strategies

3 distinct phases with different risk and return profiles

Note: NRA is an abbreviation for Normal Retirement Age. This is simply the date you retire

More about the Pre-retirement phase

Here we will gradually and automatically switch you to lower-risk funds that are aligned with how you’d like to take your retirement benefits.

Video Library

In our short video Stephen Rice gives you a 1-minute snapshot on My Future ESG Lifestyle Strategies

Transcript

.00:00:00 Video Starts

00:00:05 - Question

Stephen Rice One Minute Pitch.

Aviva My Future ESG Lifestyle Strategies.

Your time starts now. What are the Aviva Lifestyle Strategies?

00:00:15 - Stephen

They are three pension savings strategies tailored to your selected retirement age and whether you're looking to fund for an approved retirement fund annuity or a lump sum at retirement.

00:00:25 - Question

How are my Pension savings managed?

00:00:27 - Stephen

Aviva will automatically deviate your pension from higher risk funds to lower risk funds as you near retirement, so you don't have to.

00:00:34 - Question

Where are my Pension savings invested?

00:00:36 - Stephen

Your money is invested in a combination of equities and bonds to Aviva's Fixed Allocation ESG Funds and in the last five years a cash allocation is introduced to meet your tax-free lump sum.

00:00:46 - Question

As these are ESG strategies. Will my savings be invested sustainably?

00:00:50 - Stephen

Yes. Our fixed allocation range is designated as Article 8 under the Sustainable Finance Disclosure Regulations.

00:00:56 - Question

What are the advantages of investing in this manner?

00:00:58 - Stephen

The My Future Strategies are cost effective investment strategies professionally managed by Aviva Investors.

00:01:04 - Question

And how much does My Future ESG cost?

00:01:06 - Stephen

They are available at a 0.1% discount to our standard management charges.

00:01:11 - Question

Stephen, your time is up.

For more information on Aviva's My Future ESG Lifestyle Strategies and how to invest, contact your financial broker.

00:01:34 Video Ends

Expert advice

Want expert advice on pensions and retirement? Contact your Financial Broker today.

Warnings

Important information to consider.

| Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Warning: The income you get from your ARF may go down as well as up. Warning: If you invest in these funds you may lose some or all of the money you invest. Warning: If you invest in this product you will not have any access to your money until you retire. Warning: These products may be affected by changes in currency exchange rates. |

|---|

1. The European Regulations are the Sustainable Finance Disclosure Regulation (Regulation (EU) 2019/2088) (SFDR). This regulation is designed to improve transparency in relation to sustainability risks and impacts in relation to financial products in the market and make it easier for investors to distinguish and compare the available sustainable investing strategies. For more information on the Sustainable Finance Disclosure Regulation (“SFDR”), please go to: https://www.aviva.ie/fund-range/responsible-investments/ to see Aviva Sustainability Policy.

Aviva Life & Pensions Ireland Designated Activity Company, a private company limited by shares. Registered in Ireland No. 165970. Registered office at Building 12, Cherrywood Business Park, Loughlinstown, Co. Dublin, D18 W2P5. Aviva Life & Pensions Ireland Designated Activity Company, trading as Aviva Life & Pensions Ireland and Friends First, is regulated by the Central Bank of Ireland. Tel (01) 898 7950 www.aviva.ie