When you’re sorting out car insurance, there’s one type of cover that often gets mentioned but might leave you scratching your head—Open Drive Insurance. If you’ve ever wondered what exactly it means and how it could benefit you, you’re not alone! Let’s dive into the details, so you can make a more informed decision about your car insurance options.

What is Open Drive Insurance?

At its core, Open Drive Insurance allows any driver holding a full EU or UK licence, typically over the age of 25, to drive your car with the same level of cover you have. It’s a flexible option that offers peace of mind, whether it's for the occasional road trip or a quick run to the shops, this type of cover can be a handy addition to your policy.

Most insurance policies will cover only named drivers, meaning only those specified in the policy are insured to drive your car. With Open Drive Insurance, you extend that coverage to a wider pool of drivers, without needing to name them individually.

Benefits of Open Drive Insurance

- Convenience: Have you ever been in a situation where you needed someone else to drive your car? Maybe you’ve had a long day, or you’re just not up to the drive home. With Open Drive Insurance, you won’t have to worry as someone else can drive your car once they meet the age and licence requirements.

- Flexibility: Whether it's a family member borrowing your car or a friend helping with a big move, Open Drive Insurance allows them to hop behind the wheel without the hassle of making changes to your policy, so long as they meet the age and licence requirements.

- Peace of mind: You can relax knowing that your car is covered in the event of an accident, once you have Open Drive cover and the driver meets the insurer's age and licence conditions).

Things to Keep in Mind

While Open Drive Insurance certainly has its perks, there are a few things to be aware of before adding it to your policy.

- Age restrictions: Many policies only offer Open Drive Insurance to drivers over a certain age, typically 25 or 30. Be sure to check the specific terms with your insurer. If you have younger drivers in your family, you might need to name them individually on your policy instead.

- Licence requirements: Open Drive Insurance usually only covers drivers holding full EU and UK licences. So, if you’re thinking about lending your car to someone with a learner permit, you’ll need to look at other insurance options.

- Potential higher premiums: Since Open Drive Insurance is more flexible, it can be more expensive. You’ll need to weigh up the convenience against the potential extra cost.

- Coverage limits: Always check what’s included under Open Drive Insurance. For instance, some policies might only cover third-party damage for other drivers, meaning that damage to your car won’t be covered. You might want to explore this before deciding if Open Drive Insurance is the right fit for you.

Is Open Drive Insurance Right for You?

If you sometimes lend your car to others or have multiple drivers in your household, Open Drive Insurance could be a great option. It’s also worth considering if you run a small business where employees sometimes need to use your car.

However, if you’re the only one who drives your car or rarely lend it out, you might not need the added flexibility. A standard car insurance policy with named drivers could work just fine for you.

How do I get Open Drive Insurance?

At Aviva, we aim to make your insurance decisions as straightforward as possible. If Open Drive Insurance sounds like the cover you need, the best thing you can do is get in touch with us. We’ll help you figure out whether it fits your circumstances and talk you through any specific requirements and cover provided.

You can also explore our car insurance quotes online to see how adding Open Drive Insurance might affect your premium.

Need more advice? Our team at Aviva is always here to help you find the right insurance policy to suit your needs.

Open Drive Insurance FAQs

- Can anyone drive my car with Open Drive Insurance? Typically, Open Drive Insurance covers drivers over the age of 25 who hold a full EU or UK driving licence. However, always check with your insurer for specific requirements and the level of cover provided.

- Is Open Drive Insurance more expensive? It can be more expensive, but it offers the added convenience of flexibility for multiple drivers. Always compare quotes to see what works best for you.

- Does Open Drive Insurance cover all types of vehicles? This depends on your policy. Some insurers may limit Open Drive Insurance to specific vehicle types, so it's worth double-checking with your provider.

Tip: Find more information about Car Insurance FAQs here.

Multi Car Insurance Discounts

Save 10% on a second car's premium with Aviva Multicar DiscountFootnote [2].

More than one car to insure in the household? No problem. With Aviva Multicar discount, you can insure them all with us and get a savvy saver discount. Want to hear more?

15% online car insurance discount¹

Get a quote or learn more about our car insurance.

Car articles

Take a look at our library of helpful articles and latest car insurance news.

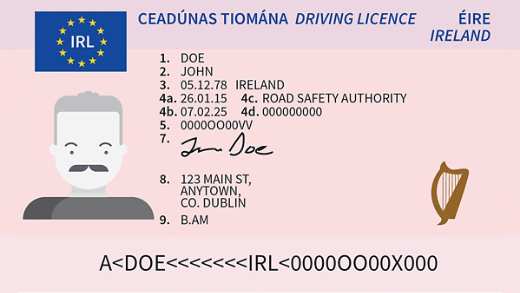

New driver number rules

From 31st March 2025, drivers in Ireland will need to provide their driver number when buying or renewing car insurance.

Penalty Points in Ireland and car insurance

Did you know you can reduce your car insurance premium by being penalty points free? Safe driving is key. Guide on penalty points and car insurance.

How Much Does It Cost to Charge an Electric Car in Ireland?

Our guide explains the difference in costs between charging at home and a public chargepoint, and the grants that come with choosing to buy an electric car.

Car seats – Safe driving with children

From newborn car seats to booster seats, this guide will take you through the best features for each age group to keep children safe while driving.

10 Common Reasons Cars Break Down

Let’s explore some of the most common reasons cars can break down and how to avoid them, ensuring you stay safe and secure on the road.

What to Do if You Have a Used Car Problem

Buying a new vehicle can be exciting, but excitement can turn to panic if you find a problem with a second-hand car.

NCT vs MOT: The Differences for Irish and UK Drivers

There are key differences between the NCT and MOT systems that drivers should be aware of, especially if you are looking to buy an import from the UK.

Here's What You Need to Know to Import a Car to Ireland

We’ll cover considerations for importing a car to Ireland, including how to insure your imported car, stay within budget, and key details to keep in mind.

Nine step ultimate checklist before driving

Maintaining your vehicle is crucial - to help drivers as they prepare to travel, we’ve put together a 9 -step ‘ultimate’ checklist.

A very special Christmas surprise!

Witness pure excitement unfold as what appears to be a routine car fix turns into an unforgettable surprise for 12-year-old Taylor Swift superfan, Eleanor.

Higher or Lower with Irish Rugby players

We put a few Irish Rugby Players through their paces with a game of Higher or Lower! Jimmy O’Brien, Jordan Larmour and Jack Conan were the brave contestants.

Holidaying at home: Your complete guide to green getaways – Part Two

In part two of our eco staycations guide, we look at three further Irish destinations to holiday with the environment in mind. So, you’ll be ready to staycation!

Lost Driving Licence? Here’s What You Need to Know

If you need a replacement driving licence but don’t know where to start, here’s all the information you need.

The Best Small Electric Cars in Ireland 2023

Are you looking to switch from a conventional vehicle to an electric car? Find out about the most popular small EVs that are on the market in 2023.

Top five Irish beaches for a sunny day

From the cove of Keem Bay on Achill Island to Portmarnock’s sandy shores, read on to check out our top five picks for the best Irish beaches for a sunny day…

Making memories: Your guide to unmissable summer family days out

Take a look at our carefully curated list of the best family-friendly activities – with choices suitable for all ages, budgets and interests.